When you hear the term IEO pop up on crypto forums, you might wonder if it’s just another buzzword or something worth your attention. In plain English, an IEO is a way for new crypto projects to raise money directly through a cryptocurrency exchange, instead of doing it on their own website. Think of it as a storefront where the exchange vouches for the project, handles the token sale, and lets investors buy with a few clicks. This article walks you through what an IEO really is, how it differs from similar fundraising models, the steps to join one, and the pros and cons you should weigh before jumping in.

Defining the Core Concepts

IEO is a fundraising method where a cryptocurrency exchange hosts the token sale on behalf of a blockchain project. The exchange runs the KYC process, holds the tokens in escrow, and distributes them to buyers once the sale ends. To make sense of an IEO, you also need to know what a crypto exchange is a platform that allows users to trade digital assets like Bitcoin, Ethereum, and newly issued tokens does. Exchanges act as intermediaries, matching buyers and sellers while providing wallets, order books, and security measures.

Another building block is the token a digital asset issued on a blockchain that can represent utility, equity, or a currency unit. Tokens are the product being sold in an IEO, and their value depends on the project’s success and market demand.

How an IEO Differs from ICOs and STOs

Before 2025, most people heard about ICO Initial Coin Offering, a DIY token sale run by the project team on its own website. ICOs gave projects total control but also placed all the compliance and security responsibilities on them. This led to a wave of scams and regulatory crackdowns.

Enter the STO Security Token Offering, where tokens are treated as securities and must comply with financial regulations. STOs offer legal protection but require extensive paperwork and often limit the investor pool.

An IEO blends the accessibility of an ICO with the trust layer of an exchange, while usually sidestepping the heavy licensing that STOs demand. The exchange’s reputation becomes the project’s backstop, and investors benefit from built‑in KYC, escrow, and immediate listing after the sale.

| Feature | IEO | ICO | STO |

|---|---|---|---|

| Who hosts the sale | Crypto exchange | Project team | Regulated entity |

| KYC/AML | Handled by exchange | Often minimal | Strict compliance |

| Regulatory oversight | Exchange’s policies | Low | High (securities law) |

| Token custody during sale | Escrowed by exchange | Project‑controlled | Custodian‑managed |

| Post‑sale listing | Immediate on host exchange | Varies, often delayed | Listed on compliant platforms |

| Typical investor base | Retail + accredited | Retail‑heavy | Accredited & institutional |

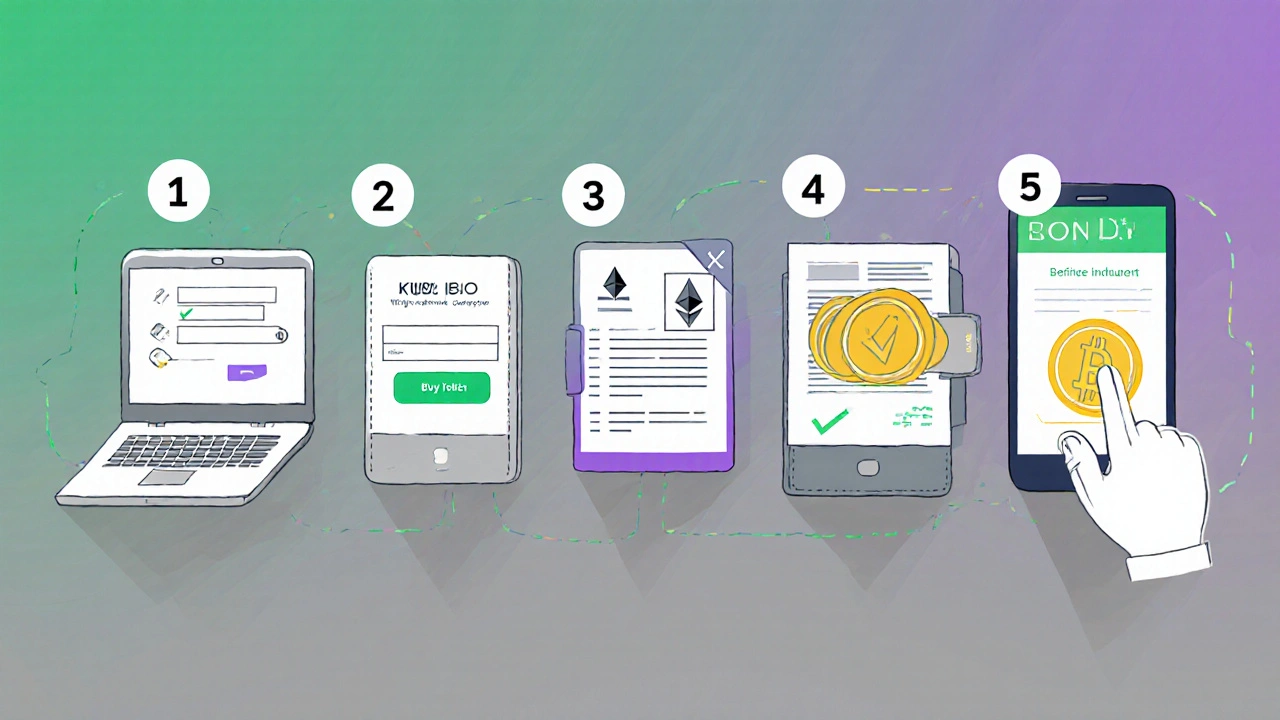

Step‑by‑Step: How to Participate in an IEO

- Choose a reputable exchange that hosts IEOs. In 2025, Binance, KuCoin, and Bybit remain the top three platforms, each publishing a calendar of upcoming offerings.

- Create an account and complete the KYC/AML verification. The exchange will ask for a government‑issued ID, a selfie, and proof of address.

- Deposit the required cryptocurrency-most IEOs accept Bitcoin (BTC), Ethereum (ETH), or the exchange’s native token (e.g., BNB on Binance).

- Review the project’s whitepaper, tokenomics, and roadmap. Look for clear allocation of funds, a realistic development timeline, and a transparent team.

- When the sale opens, place your order. Exchanges often use a fixed‑price model, meaning you pay a set amount per token, unlike a Dutch auction.

- After the IEO closes, the exchange releases the tokens to your exchange wallet. Some platforms automatically list the token for trading; others may require a short waiting period.

Advantages of the IEO Model

1. Trust factor: The exchange’s brand acts as a vetting layer, reducing the risk of outright scams.

2. Streamlined compliance: KYC is handled once, so you don’t have to submit documents to each project.

3. Immediate liquidity: Tokens often appear on the host exchange right after the sale, letting you trade immediately.

4. Escrow protection: Funds are held by the exchange until the sale’s conditions are met, shielding investors from premature fund release.

Potential Drawbacks and Risks

1. Exchange dependency: If the exchange suffers a hack or technical outage during the sale, participants could miss out or lose funds.

2. Limited project control: Some founders prefer to manage the sale themselves to retain flexibility over pricing and token distribution.

3. Higher fees: Exchanges charge listing fees and may take a cut of the raised capital, which can reduce the amount the project receives.

4. Regulatory gray area: While exchanges enforce KYC, IEOs still sit in a murky regulatory space that could face future restrictions.

Top Platforms Running IEOs in 2025

- Binance Launchpad Binance’s flagship IEO platform, known for high‑profile token launches and deep liquidity

- KuCoin Spotlight KuCoin’s curated IEO service, focusing on early‑stage projects with strong community support

- Bybit IEO Bybit’s emerging IEO hub, offering lower fees and a fast‑track listing process

- Gate.io Startup Gate.io’s platform for niche projects, especially in DeFi and gaming sectors

Practical Tips for Staying Safe

- Always verify the exchange’s URL and enable two‑factor authentication.

- Check that the project’s token contract is audited by a reputable firm (e.g., CertiK or Quantstamp).

- Limit your exposure: treat an IEO as a high‑risk investment and allocate only a small portion of your crypto portfolio.

- Keep records of your transaction hashes and KYC submissions; they can be useful if you need to dispute a charge.

Frequently Asked Questions

What exactly does an IEO stand for?

IEO means Initial Exchange Offering. It’s a token sale that takes place on a cryptocurrency exchange rather than on the project’s own website.

How is an IEO different from an ICO?

In an ICO the project runs the sale themselves, handling KYC, token distribution, and often facing little oversight. An IEO hands those responsibilities to a trusted exchange, which conducts KYC, holds funds in escrow, and usually lists the token immediately after the sale.

Do I need to hold a specific cryptocurrency to join an IEO?

Most exchanges accept Bitcoin (BTC), Ethereum (ETH), and their own native token (like BNB on Binance). Check the IEO’s terms page for accepted currencies before depositing.

Is an IEO safe from scams?

IEOs lower risk because the exchange screens projects, but they’re not foolproof. Always do your own due diligence on the team, tokenomics, and audit reports.

What fees should I expect when buying an IEO token?

Exchanges typically charge a small transaction fee (0.1‑0.5%) and may include a listing fee paid by the project, which doesn’t affect the buyer directly. Some platforms also have a minimum purchase amount.