When you send $100 worth of cryptocurrency to a friend, you expect it to still be $100 when they receive it. But if that crypto is Bitcoin or Ethereum, the value could swing 10% in minutes. That’s why stablecoins exist - to act like digital cash that doesn’t randomly lose or gain half its value overnight. The real magic isn’t in the blockchain tech. It’s in how they stay stable. Three main systems keep these tokens anchored to $1: collateralization, pegs, and reserve management.

Fiat-Backed: The Simplest Way to Stay Stable

Most stablecoins you’ve heard of - USDC, USDT, BUSD - are backed by actual dollars. For every token issued, the issuer holds $1 in cash or cash-like assets. It sounds straightforward, but the details matter. Circle’s USDC, for example, keeps 89.7% of its reserves in short-term U.S. Treasury bonds. The rest is in cash and a few other low-risk assets. These aren’t just sitting in a vault. They’re invested to earn interest, which helps cover operational costs. Every month, an independent auditor checks the reserves and publishes the report. As of November 2025, USDC’s reserves matched its circulating supply within 0.02%.

This model works because it’s simple. If you want to cash out your USDC, you can redeem it for $1 through Circle’s partner banks. That’s why it’s the most trusted model. Over 85% of all stablecoin volume runs on this system. But there’s a catch: you’re trusting a company. In February 2024, Paxos had to stop issuing BUSD after the New York State regulator pulled its license. Suddenly, users couldn’t mint new tokens. Some even had existing holdings frozen during compliance reviews. So while the peg holds tight, the system isn’t fully decentralized. It’s a trade-off: reliability for control.

Crypto-Backed: Decentralized, But Complex

What if you don’t want to trust a company? MakerDAO’s DAI offers an alternative. Instead of dollars, you lock up Ethereum (ETH) as collateral. To mint $10,000 worth of DAI, you need to deposit at least $15,000 worth of ETH. That’s a 150% collateralization ratio - and it’s not just a number. It’s a safety buffer. When ETH crashes, the extra value absorbs the drop. If ETH falls 30%, your $15,000 collateral might drop to $10,500. But since you only borrowed $10,000 DAI, you’re still safe. The system only triggers a liquidation if your collateral falls below the 150% threshold.

Chainlink oracles feed real-time ETH prices into the protocol every 30 seconds. If the price drops too fast, automated auctions sell off your ETH to cover the debt. In May 2025, when ETH dropped 35% in 24 hours, MakerDAO handled it. But not without cost: over 1,200 positions were liquidated, totaling $87 million in ETH sold at discounted rates. Users who didn’t monitor their collateral ratios lost big. DAI’s peg held within 0.5% during the crash - impressive for a crypto-backed system. But it’s not easy to use. You need to understand stability fees, liquidation penalties, and how oracles work. Most people use it through DeFi apps, not directly. Still, it’s the only stablecoin that doesn’t rely on banks or auditors. That’s why 62% of DeFi lending platforms accept DAI as collateral.

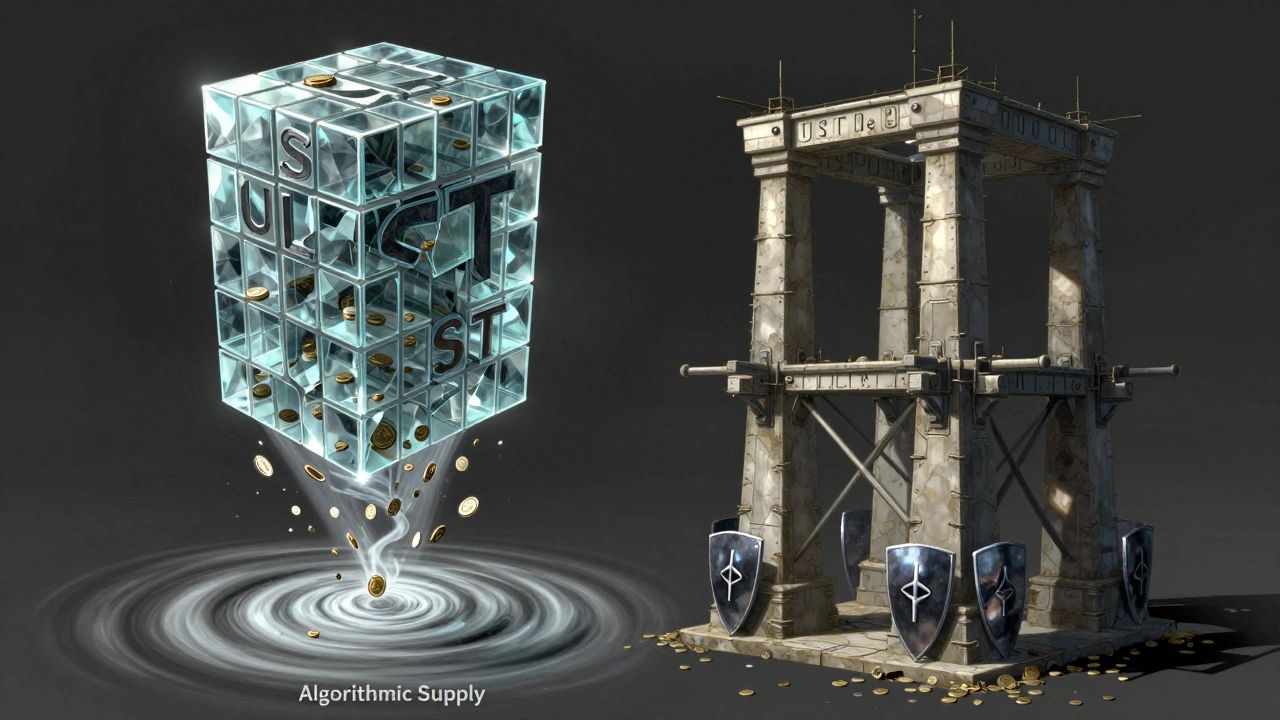

Algorithmic: The High-Risk Experiment

Then there’s the wild card: algorithmic stablecoins. These don’t hold any real assets. Instead, they use code to expand or shrink the supply of tokens to control price. Ampleforth (AMPL) does this daily. If the price rises above $1, the system gives everyone more tokens. If it falls below $1, it takes some away. The idea is that more supply lowers the price; less supply raises it. But this doesn’t work well under stress. When markets panic, people sell. More supply just means more selling pressure. The result? AMPL has swung from $0.70 to $1.80 in a single week.

Frax (FRAX) tried to fix this with a hybrid model. It’s 65% backed by USDC and 35% algorithmic. That means it’s not fully on the hook for price swings. If FRAX drops to $0.98, the algorithm mints new FRAX and sells it for USDC to buy back the cheap tokens. It’s a balancing act. In 2025, FRAX maintained a 99.6% peg - better than pure algorithmic models. But it’s still not as stable as USDC. The biggest failure? TerraUSD (UST). In May 2022, UST lost its peg, triggered a death spiral, and wiped out $40 billion in market value. No reserves. No safety net. Just code. The Bank for International Settlements called it a textbook case of what not to do.

Hybrid Models: The Emerging Winner?

The most promising innovation isn’t a pure model - it’s a mix. Ethena’s USDe is built on staked Ethereum. Instead of holding dollars, it uses yield from staking ETH to fund a delta-neutral hedge. Think of it like this: you earn interest from staking ETH, then use that income to bet against ETH’s price falling. If ETH goes up, you gain on your staking. If it drops, your hedge covers the loss. The result? A stablecoin that earns yield while staying pegged. In 2025, USDe held a 99.2% peg and generated $1.2 billion in annual yield for holders.

MakerDAO’s Endgame Plan took a similar approach. It now splits DAI into subDAOs, each managing different collateral types - from ETH to real estate tokens. It also added surplus buffers to absorb volatility without liquidating users. These aren’t just upgrades. They’re responses to past failures. Research from the Cambridge Centre for Alternative Finance shows hybrid models are 40% more stable during market shocks than pure models. That’s why regulators are starting to take notice. The EU’s MiCA law now requires 100% reserve backing, but it doesn’t ban algorithmic models outright - it just demands transparency and risk controls.

Who Uses These, and Why?

Most stablecoin activity is in trading. Sixty-three percent of all stablecoin transactions are used to move between crypto assets without touching fiat. Traders use USDC to quickly exit positions during crashes. But they’re also used for remittances. In Latin America and Southeast Asia, people send money across borders using USDC because it’s faster and cheaper than Western Union. Chainalysis found 37% year-over-year growth in algorithmic stablecoin usage in these regions - not because they’re more stable, but because they’re easier to access without a bank account.

Enterprises are jumping in too. JPMorgan’s Onyx blockchain processes $1.2 billion daily in JPM Coin - its own fiat-backed stablecoin. The Bank of England’s Project Rosalind found that 78% of banks plan to use stablecoins for wholesale payments within two years. Why? Because settlement happens in seconds, not days. And unlike traditional systems, there’s no need for intermediaries.

What’s at Stake?

The U.S. Federal Reserve warned in November 2025 that stablecoins could become a systemic risk. If a major issuer like Tether or Circle suddenly froze redemptions, it could trigger panic across crypto markets - and spill over into traditional finance. That’s why regulators are pushing for full reserve transparency. Circle’s USDC v3, launched in September 2025, now offers real-time on-chain proof of reserves using Chainlink oracles. You can check your USDC balance against the reserve on the blockchain, instantly.

But the biggest threat isn’t regulation. It’s complacency. Users assume their stablecoin is as safe as a bank account. It’s not. DAI can be liquidated. Algorithmic tokens can crash. Even USDC can be frozen. The only thing that’s truly stable is understanding how your token works. Know your collateral. Know your issuer. Know your risk.

Choosing the Right Stablecoin

Here’s how to pick:

- For safety and simplicity: Use USDC or USDT. They’re pegged tightly. But remember: you’re trusting a company.

- For decentralization: Use DAI. It’s trustless, but you need to understand collateralization and liquidation risks.

- For yield and innovation: Try USDe or FRAX. They’re more complex, but offer returns and evolving tech.

- Avoid: Pure algorithmic stablecoins like AMPL unless you’re actively monitoring and trading them.

There’s no perfect system. But the best one for you depends on what you value: speed, decentralization, yield, or safety. Most users start with USDC. As they learn, they explore DAI. The future belongs to hybrids - systems that combine the best of both worlds.

Are stablecoins really worth $150 billion?

Yes. As of November 2025, the total market cap of all stablecoins is $150.3 billion, according to CoinGecko. That’s 12.7% of the entire cryptocurrency market. Most of that value is in USDC and USDT, which together make up over 80% of the total.

Can I lose money with a stablecoin even if it’s pegged to $1?

Absolutely. If you hold USDC and Circle freezes your account due to compliance, you can’t access your funds for days. If you use DAI and your collateral drops too fast, you can get liquidated and lose part of your ETH. Algorithmic stablecoins like UST have collapsed entirely, wiping out 100% of user holdings. The peg doesn’t mean safety - it just means the price target.

Why does DAI need 150% collateral when it’s supposed to be $1?

Because Ethereum’s price can drop fast. If you lock $10,000 worth of ETH to mint $10,000 DAI, and ETH falls 20% in an hour, your collateral is now worth $8,000 - but your debt is still $10,000. That’s undercollateralized. The 150% buffer gives the system time to react. If ETH drops 30%, your collateral is still worth $10,500, which covers the $10,000 debt. The extra 50% is insurance against volatility.

Is USDC safer than DAI?

It depends on what you mean by “safer.” USDC has a near-perfect peg and is easier to use. But it’s centralized. Circle can freeze your funds. DAI has no central authority, so no one can freeze you - but you can get liquidated if you don’t manage your collateral. USDC is safer from price crashes. DAI is safer from corporate control.

What’s the future of stablecoin stability?

The future is hybrid. Pure fiat-backed models face regulatory pressure to be fully transparent. Pure algorithmic models are seen as too risky. The winners will be systems like USDe and MakerDAO’s Endgame Plan - combining real assets with smart code to balance safety, decentralization, and yield. By 2028, only stablecoins with full reserve transparency and shock-absorbing mechanisms will survive.

10 Responses

I just started using USDC last month and honestly? It’s been a game-changer. No more worrying about my crypto losing half its value before I can even cash out. 😊

Okay but have you ALL seen what happened to UST?? Like, one minute you’re thinking you’ve found the holy grail of stablecoins, next minute your entire portfolio is just digital confetti?? 💥 I’m not even mad, I’m just impressed at how fast it all collapsed. Like, imagine your bank account vanishing because the algorithm got a bad day. 🤯

I think the real takeaway here is that no system is perfect. USDC is safe but centralized. DAI is decentralized but you need to be a crypto nerd to use it without losing money. The hybrid models are promising because they’re trying to have their cake and eat it too. I’m not convinced yet, but I’m watching closely.

It’s funny how we call these things ‘stable’ like they’re some kind of emotional anchor. But really, they’re just mathematical illusions wrapped in whitepapers. We’re all just trying to pretend money doesn’t have to be chaotic. Maybe the real stablecoin is cash in your pocket. Or, y’know, not having any money at all. 🤷♀️

So… USDC is good? DAI is confusing? Got it. I’ll stick with USDC. Done.

Wait-so you’re telling me that a $150 BILLION industry is built on the idea that a company can just… freeze your money if they feel like it? And people are okay with that? And you call this innovation? You know what’s innovative? A bank account that doesn’t require a lawyer to understand the TOS. But nooo, we need blockchain. 🙄

This is why India needs its own stablecoin. Not backed by US dollars. Not controlled by Silicon Valley. We have 1.4 billion people who need fast, cheap payments. Why are we still using USDC? It’s colonialism with crypto. We need DAI or hybrid models that don’t rely on American banks. End of story.

I appreciate the breakdown, but I think we’re missing a key point: stability isn’t just about price. It’s about access, transparency, and recoverability. USDC has the peg, but if Circle freezes you, your ‘stable’ asset becomes useless. DAI has no central point of failure, but if you’re not monitoring your collateral, you get wiped. The real win is when the system protects you even when you’re not paying attention. That’s what hybrid models are trying to do-and honestly? I’m rooting for them.

You guys are overthinking this. USDC is the only one that matters. If you’re using DAI or FRAX or whatever, you’re just gambling with your savings. And if you think algorithmic stablecoins are the future, you’re living in a fantasy. UST didn’t just fail-it was a nuclear bomb. And now you’re all acting like it was just a hiccup. Wake up.

I’ve been holding DAI for over a year now. I’ve had two liquidations-both because I was lazy and didn’t check my collateral. Lost about $300 total. But I still use it. Why? Because I don’t trust any company to hold my money. Even if Circle says they’re transparent, they’re still a corporation. And corporations answer to shareholders, not users. DAI’s a pain in the ass, but it’s mine. No one can take it. And that’s worth the hassle.