Back in 2009, mining Bitcoin was something you could do on a regular laptop. Now, if you try to mine alone with a single GPU, you might wait years to find a single block-and even then, the electricity cost would eat up your profits. That’s where mining pools come in. Instead of going it alone, hundreds or thousands of miners join forces, combining their computing power to find blocks faster. When a block is found, the reward is split based on how much work each miner contributed. It’s not glamorous, but it’s the only way most people still make money mining today.

Why Mining Pools Exist

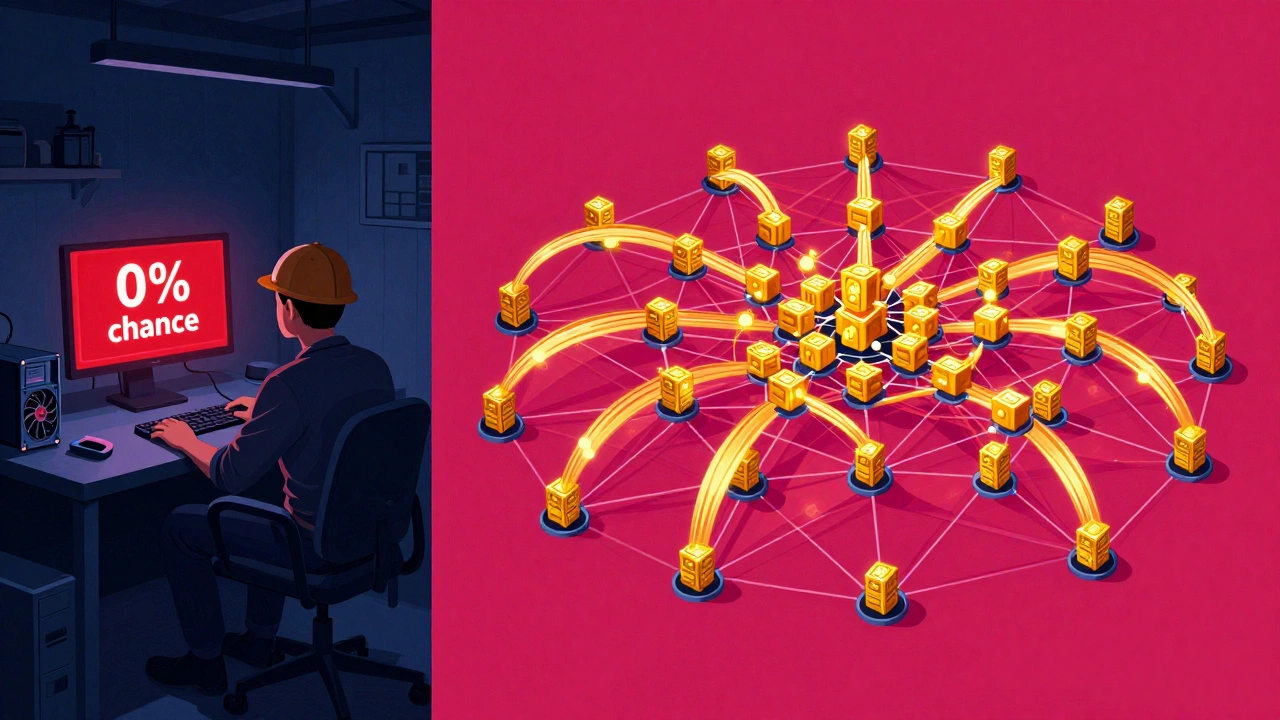

Bitcoin’s difficulty adjusts every two weeks to keep blocks coming every 10 minutes. As more powerful hardware entered the game-especially ASICs designed solely for mining-the odds of a solo miner winning dropped to near zero. By 2024, the network difficulty hit 1.27 × 10^24 hashes. That means your average home rig, even with a top-end GPU, has less than a 0.000001% chance of finding a block on its own. Mining pools solve this by pooling hash power. Think of it like buying lottery tickets together: instead of one person spending $100 on a single ticket, 100 people chip in $1 each. If someone wins, they split the prize. The math doesn’t change the odds of winning-but it makes winning predictable.How Mining Pools Work

A mining pool runs a central server that sends work assignments to connected miners. Each miner tries to solve a smaller version of the Bitcoin puzzle-called a “share”-and submits it back. These shares don’t earn blocks, but they prove you’re doing real work. The pool tracks every share submitted by each miner. When the pool finally finds a full block, it pays out rewards based on the number of shares each miner contributed over a set period. Most pools use either the Pay-Per-Last-N-Shares (PPLNS) or Proportional method. PPLNS is more fair: it rewards miners who stayed loyal during the winning streak, not just those who happened to be online when the block dropped. PPLNS pays out 17.3% more consistently than proportional payouts, according to River Financial’s 2024 report.Protocols That Keep Pools Running

The communication between your miner and the pool happens over protocols. The most common one is Stratum v1, used by 85% of pools as of 2024. It’s simple and reliable. Stratum v2, rolled out by 60% of major pools since late 2024, is the next step. It gives miners more control over which transactions go into the blocks they’re mining. Before, pool operators decided what went into each block. Now, with Stratum v2, miners can choose transactions, reducing the risk of centralization. Other protocols like GetBlockTemplate (GBT) are still around but fading fast. You don’t need to understand the tech deeply-just make sure your mining software supports the pool’s protocol.Types of Mining Pools

There are three main types of pools, each with trade-offs:- Centralized pools (like Antpool, F2Pool, and Ethermine) are the most popular. They’re easy to join, have low setup barriers, and offer 24/7 support. But they control huge chunks of the network. As of August 2024, the top four pools held 51.3% of Bitcoin’s total hash rate. That’s a centralization risk-if one goes down or acts maliciously, it could disrupt the network.

- Peer-to-peer pools (like P2Pool) don’t have a central server. Miners connect directly to each other. This removes single points of failure and increases decentralization. But you need to run a full Bitcoin node, which requires 300+ GB of storage and a steady 2 Mbps connection. Most home miners avoid this because it’s complex and expensive to maintain.

- Multipools (like NiceHash and Luxor) automatically switch between different cryptocurrencies based on which one is most profitable right now. They check exchange rates and block times every 30 seconds. According to EMCD.io’s 2024 benchmark, multipools generate 12-15% higher returns than single-coin pools. They’re great for miners with flexible hardware, like GPU rigs that can mine Ethereum Classic, Ravencoin, or Zcash.

Fees, Payouts, and What You Actually Earn

No mining pool is free. Most charge between 0.5% and 3% of your rewards. Slush Pool, the oldest one still running, charges a flat 2%. Luxor charges 0.5%-but only if you’re mining Bitcoin. If you’re mining altcoins, fees jump to 1.5%. Some pools, like 2Miners, increase fees during “network stress,” defined as when hash rate volatility exceeds 10%. That’s when fees can spike from 2.5% to 4%. Check the fine print. Payout thresholds matter too. If you set your payout threshold too low-say, 0.001 BTC-you’ll get paid daily, but you’ll pay a transaction fee every time. That fee eats into your earnings. Most miners set thresholds between 0.005 and 0.01 BTC to avoid wasting money on fees. A 2024 survey found that 41% of new miners set thresholds too low, costing them an average of 3.7% in lost revenue.Hardware and Connection Requirements

You don’t need a data center to join a pool, but you need decent gear. For Bitcoin, you need ASIC miners with at least 100 TH/s hash rate to break even after electricity. Global average electricity cost is $0.07/kWh, so anything below that efficiency won’t pay off. For Monero or other CPU-friendly coins, even a $200 used laptop can mine profitably with 1-5 KH/s. Your internet connection matters too. You need at least 10 Mbps upload speed. Mining pools send work and receive shares constantly-sometimes 10 to 100 times per minute per miner. If your connection drops, you lose shares, and your payout drops with them.Real-World Problems Miners Face

Even with a good pool, things go wrong. In November 2024, F2Pool had a 72-hour outage. Miners lost an estimated $3.2 million in unrewarded work. That’s why uptime matters. Bitdeer’s 2024 metrics say top pools must maintain 99.5% uptime. If your pool drops below that, switch. Another issue is IP bans. Some pools ban IPs that submit too many invalid shares or connect from too many locations. About 28% of miners report this problem. The fix? Use a rotating proxy service-costs $15-$50/month. Also, watch out for shady pools. In March 2024, a pool called HashMiner vanished with $18,300 in miner rewards. Always check reviews on Trustpilot or Reddit. Slush Pool has a 4.3/5 rating with 427 reviews. F2Pool sits at 3.1/5, mostly because of past outages.

Who’s Really Mining?

You might think mining pools are full of hobbyists. They’re not. As of July 2024, institutional miners-companies, hedge funds, crypto firms-controlled 68% of all hash rate in pools. Individual miners make up just 32%. That’s because ASICs cost $3,000-$10,000 each. Most people can’t afford to buy and run them. The real miners are in places like Texas, Kazakhstan, and Georgia, where electricity is cheap. In North America, 34% of pool participants are based. Asia leads with 29%, Europe at 22%, and South America at 15%.What’s Next for Mining Pools?

The future is changing fast. Stratum v2 adoption is growing, giving miners more control. Poolin’s “Decentralized Autonomous Pool” prototype, launched in November 2024, uses smart contracts to run without any human operator. If it works, it could be the end of centralized pool control. Multipools are also rising. Gartner predicts they’ll grow from 15% to 38% of the market by 2027 as their algorithms get smarter. But there’s a dark cloud: rising ASIC efficiency (up 19% yearly) and Bitcoin’s halving events are squeezing profits. The University of Edinburgh warns that if electricity stays above $0.06/kWh, 43% of current pools will fold by 2027.How to Get Started

If you want to join a mining pool, here’s how:- Choose your coin. Bitcoin? Use BTC.com or Antpool. Ethereum Classic? Ethermine. Monero? SupportXMR.

- Set up your hardware. For Bitcoin, get an ASIC. For altcoins, use a GPU rig. Make sure it’s at least 95% efficient.

- Download mining software. CGMiner, BFGMiner, or NiceHash Miner. Configure it with your pool’s server address and your worker name.

- Connect and monitor. Log into your pool’s dashboard. Watch your hash rate, shares submitted, and estimated earnings. Don’t panic if payouts are small-consistency is the goal.

For beginners, expect to spend 8-32 hours learning the setup. Bitpanda Academy found new miners take longer if they’ve never used mining software before. Use Hiveon’s documentation-it’s rated 4.6/5 for clarity. And never skip testing: run your miner for 24 hours before investing more money.

Final Thoughts

Mining pools aren’t perfect. They’re centralized, sometimes unreliable, and take a cut. But they’re the only way most people still earn cryptocurrency through mining. Without them, solo mining would be a relic of the past. For now, they’re essential infrastructure. The key is choosing the right one: low fees, good uptime, transparent payouts, and solid support. If you’re serious about mining, treat it like a business-not a hobby. Track your costs, monitor your pool’s health, and always have a backup plan.Do mining pools guarantee profits?

No. Mining pools make payouts more consistent, but they don’t guarantee profit. If electricity costs are too high, or your hardware is inefficient, you’ll lose money even in a pool. Profitability depends on your hash rate, electricity price, and pool fees. Always run a profitability calculator before investing in hardware.

Can I mine without joining a pool?

Technically yes, but practically no-for Bitcoin and most major coins. Solo mining with consumer hardware now takes years to find a block. Even with a $5,000 ASIC, you’d statistically find a Bitcoin block once every 58 days. Most miners earn nothing over months. Pools turn that into daily payouts, even if small.

Which mining pool has the lowest fees?

Luxor charges 0.5% for Bitcoin mining, the lowest among major pools. Slush Pool and F2Pool charge 2%, while 2Miners charges 2.5%. But low fees aren’t everything-payout reliability and uptime matter more. A 0.5% fee with frequent outages costs more than a 2% fee with 99.9% uptime.

What’s the difference between Stratum v1 and v2?

Stratum v1 lets the pool operator decide which transactions go into blocks. Stratum v2 gives miners the power to choose transactions themselves. This reduces centralization risk and prevents pool operators from censoring or manipulating transactions. As of Q3 2024, 60% of major pools use Stratum v2.

Are mining pools regulated?

Yes, increasingly so. The EU’s MiCA regulation, effective January 2025, requires pools processing over 1,000 daily transactions to implement anti-money laundering (AML) checks. This means pools may need to collect miner identities, increasing operational costs. Similar rules are expected in the U.S. and UK by 2026.

How do I know if my pool is trustworthy?

Check three things: 1) Public hash rate data-only 38% of pools publish this, so avoid the rest. 2) User reviews on Trustpilot or Reddit. 3) History of outages. Avoid pools that have had long downtime or disappeared with miner funds. Slush Pool and Ethermine have strong reputations. Never trust a pool with no public track record.

Can I mine multiple coins in one pool?

Only with multipools like NiceHash or Luxor. These automatically switch between coins based on real-time profitability. Single-coin pools (like BTC.com or Ethermine) only mine one coin. Multipools are ideal for GPU miners who can switch algorithms, but they’re not suitable for ASICs, which are built for one algorithm only.

14 Responses

Just started mining last month with a used Antminer S19. Payouts are tiny but steady. Electricity here is $0.09/kWh so I’m barely breaking even, but it’s a learning experience.

Interesting read. I’ve been using Slush Pool for over a year. Their dashboard is clunky but reliable. I don’t care about the lowest fee-I care about not losing a week’s earnings because the pool went down.

Everyone’s acting like mining pools are some kind of noble innovation but let’s be real-this is just centralized control with a fancy name. The whole point of crypto was decentralization and now we’ve got four pools controlling half the network like some corporate oligarchy. Wake up people.

And don’t even get me started on those ‘multipools’-they’re just crypto scalpers with automated scripts. You’re not mining, you’re gambling on which coin’s price is trending today.

And why are we still using Stratum v1? Because the big pools don’t want you to have control. They want you to be a dumb node in their machine. Stratum v2 is the only way forward and even then, it’s not enough.

Also, ‘profitability calculators’? Those are designed by pool operators to make you think you’re making money. They don’t account for hardware depreciation, cooling costs, or the fact your electricity bill spikes in summer.

And who the hell is running these ‘mining farms’ in Kazakhstan? Probably state-backed entities. You think your 100 TH/s ASIC is ‘independent’? It’s just a tiny cog in a geopolitical machine.

And don’t tell me ‘it’s just electricity’-the grid in Texas is barely holding together. You think your mining rig isn’t contributing to blackouts? You’re not a miner, you’re a climate criminal.

And yes, I know I sound dramatic. But if you’re not outraged by this, you’re not paying attention.

They’re watching you. Every share you submit. Every IP. Every transaction you choose in Stratum v2. They’re building a profile. This isn’t mining-it’s surveillance with a reward.

Stratum v2? That’s just a distraction. The real power is in the block template. Whoever controls the template controls the blockchain. The pools aren’t just operators-they’re gatekeepers. And they’re already colluding. You think that 51% hash rate concentration is an accident? No. It’s engineered.

And MiCA? That’s the first step. Next they’ll require biometric verification to connect your miner. Then they’ll tax your hash rate. Then they’ll shut down home mining entirely.

They’re coming for your ASIC. Don’t be naive.

There is a metaphysical irony in mining cryptocurrency: we are literally exhausting energy to validate a system that claims to transcend physicality. The blockchain, a ledger of digital ghosts, powered by the combustion of ancient sunlight. How poetic. How tragic.

And yet, we persist-not for profit, but for the illusion of participation. We tell ourselves we are decentralizing, but we are merely redistributing power into new hands, new servers, new countries.

The miner is not a pioneer. The miner is a monk in a data temple, chanting hashes into the void, hoping the gods will smile and grant a single satoshi.

Perhaps the true blockchain is not in the code, but in the quiet resignation of those who still believe in it.

Stratum v2 is the future, but let’s be honest-most miners don’t even know what a Merkle root is, let alone how to configure a transaction selection policy. The average miner is a glorified plug-and-play operator who thinks ‘hash rate’ is a brand of energy drink.

And multipools? They’re the crypto equivalent of a fast-food buffet-always changing, never satisfying, and you’re paying for the illusion of variety.

Also, anyone who says ‘I’m mining for the long term’ is either lying or delusional. The ROI on an ASIC is 18 months max. After that, it’s e-waste with a heartbeat.

And let’s not pretend PPLNS is ‘fair.’ It just punishes the transient. The loyal get rewarded, sure-but what if you had to leave for a family emergency? Too bad. Your shares vanish. The system doesn’t care.

And why do we still use Bitcoin’s 10-minute block time? Because the original design is sacred, even when it’s obsolete. We’re not innovating-we’re fossilizing.

The structural dynamics of mining pool economics reveal a fascinating tension between network security and individual autonomy. While the aggregation of hash power undoubtedly enhances block discovery efficiency, it simultaneously creates a systemic vulnerability predicated on centralized coordination points.

Moreover, the proliferation of Stratum v2, while ostensibly empowering miners with transaction selection capabilities, paradoxically amplifies the technical burden on participants who lack the infrastructure to implement decentralized transaction filtering protocols.

Additionally, the regulatory encroachment via MiCA and anticipated U.S. compliance frameworks suggests an inevitable trajectory toward KYC-integrated mining nodes-a development that fundamentally contradicts the pseudonymous ethos upon which Bitcoin’s original whitepaper was predicated.

It is worth noting that the 32% individual miner participation rate is statistically insignificant in the context of network hashrate distribution, implying that the ‘hobbyist miner’ narrative is largely a rhetorical construct deployed to maintain the illusion of decentralization.

One must also consider the environmental externalities: the marginal cost of electricity in Texas is subsidized by grid infrastructure that was never designed for continuous 24/7 industrial load. The externalized costs of cooling, grid instability, and carbon emissions are not reflected in profitability models, rendering them economically myopic.

Therefore, while mining pools remain functionally necessary, they are not ethically neutral. They are institutional intermediaries in a system that claims to eliminate intermediaries. The contradiction is not accidental-it is systemic.

OMG I JUST FOUND OUT MY ASIC IS A CLIMATE CRIME MACHINE?? 😭 I thought I was being so cool mining crypto like a tech rebel but now I feel like I’m secretly burning the planet??

Also, I switched to NiceHash and now I’m mining Monero when Bitcoin’s down and Ravencoin when Monero’s sleepy?? I feel like a crypto DJ!! 🎧💸

But wait-do I need a VPN?? Someone said my IP got banned?? I’m so confused. I just wanted to make some spare cash. Why is this so complicated??

I used to mine. Then I read about the energy use. Then I thought about the children in the Arctic. Then I uninstalled everything. I don’t need more coins. I need less guilt.

Anyone else notice how the ‘low fee’ pools always have the worst uptime? It’s like they’re competing to be the cheapest dumpster fire

For a beginner, I’d recommend starting with a small GPU rig on a coin like Monero. No ASIC needed. You can learn the software, understand shares, and see how payouts work without risking $5,000.

Also, check your power meter. Many people don’t realize how much their miner is costing them until they get the electricity bill.

So you’re telling me I need to spend $8,000 on a machine just to make $20 a month? And I have to worry about IP bans and uptime and protocols? This isn’t mining. This is a job with worse pay than Walmart.

The notion that mining pools are ‘essential infrastructure’ is a dangerous rhetorical sleight of hand. They are, in fact, the antithesis of decentralization-a centralized oligopoly masquerading as a cooperative. The very term ‘mining pool’ implies collectivization, yet the reward distribution mechanisms are proprietary, opaque, and algorithmically biased.

Stratum v2’s transaction selection feature is a cosmetic concession, not a structural reform. The pool operator still controls block templates, relay timing, and orphan rate manipulation. Miners are not participants-they are laborers.

Furthermore, the normalization of ASICs as the only viable hardware has created a hardware monoculture, rendering the network vulnerable to supply-chain coercion and geopolitical disruption. The fact that 68% of hash rate is controlled by institutions is not a market outcome-it is a failure of open access.

And yet, the community persists in celebrating these systems as ‘innovative’ or ‘efficient.’ Efficiency, in this context, is a euphemism for consolidation. We have not democratized finance. We have merely digitized feudalism.