Imagine you’re watching a live game where the referee only announces the score but never shows you the video replay. You’re told the call was fair, but you can’t check for yourself. That’s what happens when blockchain data isn’t available. Without full access to transaction data, you can’t verify if a block is legitimate. And that’s not just inconvenient-it’s a direct threat to security.

What Is Data Availability, Really?

Data availability in blockchain means every transaction in a block is publicly accessible so anyone can check it. It’s not enough for a block header to exist-you need the full data behind it. If a miner or validator publishes a block header but hides the actual transactions, they could sneak in fake payments, censor transactions, or double-spend coins. And no one would know. This isn’t theoretical. In 2023, Ethereum’s blockchain hit 1.2TB of historical data. Bitcoin’s grew from 150GB in 2020 to over 450GB by the end of 2023. That’s a lot of data to store and verify. Most home computers can’t handle it. As a result, fewer people run full nodes. And fewer nodes mean less decentralization-and less security.The Data Availability Problem

The core issue is called the data availability problem. It was formally named by Vitalik Buterin in 2018. Here’s how it works: a malicious actor creates a block, publishes the header (which looks valid), but keeps the transaction data secret. Nodes trying to verify the block can’t check if the transactions are real. So they accept it. The attacker then spends the same coins again elsewhere. No one catches it because the data was never shared. This is especially dangerous for Layer 2 solutions like Optimism and Arbitrum. These rollups process thousands of transactions off-chain and only post summaries to Ethereum. But if Ethereum can’t verify the full data behind those summaries, it can’t guarantee their validity. As Dr. Aditya Asgaonkar from ConsenSys put it: “Without data availability guarantees, rollups could be censoring transactions without users knowing.”How Blockchains Are Fixing It

Three main approaches are being used today:- Data Availability Committees (DACs) - A small group of trusted parties attest that data is available. Simple, but it defeats the point of decentralization. You’re trusting a few entities instead of the whole network.

- Erasure Coding + Data Availability Sampling (DAS) - This is the most promising. Instead of downloading the whole block, nodes randomly sample small pieces. If 50% of the network is honest, and the sampled pieces check out, the chance the full block is malicious is near zero. It’s like checking a few random pages of a book to confirm it’s not blank.

- Dedicated Data Availability Layers - Projects like Celestia and EigenDA split consensus from data storage. Celestia, launched in October 2022, only handles data availability. It doesn’t process transactions or run smart contracts. It just makes sure data is out there and verifiable. This lets rollups focus on speed without overloading Ethereum.

0G.ai’s 2023 tests showed their Authenticated Merkle Trees cut verification time by 40% compared to traditional methods. Celestia users report 10x throughput improvements after switching. That’s not hype-it’s measurable.

Trade-Offs and Risks

No solution is perfect. DACs sacrifice decentralization. DAS needs enough honest nodes to work-if too many go offline, the system fails. And complexity is a hidden danger. Dr. Steven Goldfeder from Chainalysis warned in a 2023 interview: “Over-engineering data availability could create new attack surfaces.” Developers on Ethereum Stack Exchange say data availability costs are their biggest scaling hurdle. Between 2021 and 2023, posting 10KB of data on Ethereum jumped from $0.02 to $1.75. That’s why rollups need cheaper data layers. Ethereum’s Dencun upgrade (Q1 2024) is expected to cut these costs by 90% with proto-danksharding (EIP-4844). That’s a game-changer.What This Means for Security

Blockchain’s biggest promise is trustlessness: no middleman, no blind faith. But that only works if you can verify everything. If data is hidden, you’re back to trusting someone else’s word. That’s how scams and censorship creep in. Enterprise adoption shows the stakes. A 2023 ConsenSys survey found 42% of companies using Layer 2 solutions cited data availability as their top security concern. Meanwhile, those that adopted dedicated DA layers like Celestia saw improved security posture. Financial apps led the charge-67% use enhanced DA solutions, compared to just 42% across all enterprises.

The Future Is Modular

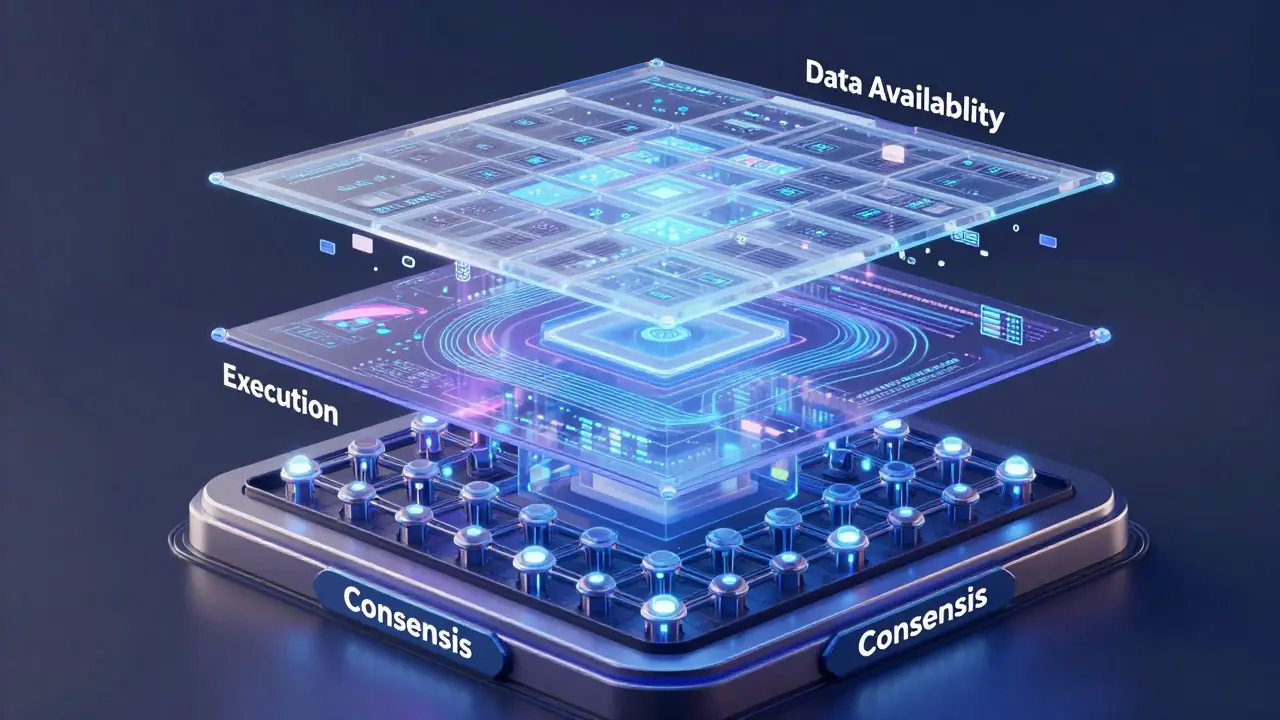

The future of blockchain isn’t one giant chain doing everything. It’s modular: separate layers for consensus, execution, and data availability. Ethereum is moving this way. Celestia and Polygon Avail are building the data layer. Rollups handle speed. And together, they scale without sacrificing security. Gartner predicts 80% of enterprise blockchains will use dedicated data availability layers by 2026. That’s not speculation-it’s inevitability. The cost of ignoring data availability is too high. Centralization, censorship, fraud-these aren’t abstract risks. They’re real outcomes when data is hidden.Why You Should Care

You don’t need to run a node to understand this. If you use a crypto wallet, a DeFi app, or even a tokenized asset, your security depends on whether the underlying blockchain can prove its transactions are real. If data availability fails, your funds are at risk-even if the app looks fine. The fix isn’t about bigger blocks or faster transactions. It’s about transparency. The same principle that made Bitcoin revolutionary-public, verifiable data-is now the key to its survival. Data availability isn’t a technical footnote. It’s the foundation.What happens if blockchain data isn’t available?

If transaction data is withheld, nodes can’t verify blocks. This opens the door to double-spending, censorship, and fraudulent transactions. Users and apps can’t tell if a transaction is real, breaking the trustless model that blockchain relies on.

Is data availability the same as blockchain size?

No. Blockchain size is how much data has been stored. Data availability is whether that data is accessible and verifiable. A blockchain can be huge but still have poor data availability if nodes can’t download or check the full data.

How does Ethereum plan to fix data availability?

Ethereum’s Dencun upgrade (Q1 2024) introduces proto-danksharding (EIP-4844), which adds a new data type called “blobs.” These blobs are cheaper to store on Ethereum and are designed specifically for rollups. This cuts data posting costs by around 90%, making it feasible for rollups to post full transaction data without breaking the bank.

Are data availability layers like Celestia secure?

Yes, if used correctly. Celestia uses data availability sampling and erasure coding to ensure data is verifiable without needing to download everything. Security relies on enough nodes sampling random pieces. As long as at least half the network is honest, malicious data withholding is nearly impossible to get away with.

Can I verify data availability as a regular user?

Not directly, but you benefit from it. Wallets and apps that connect to rollups using secure DA layers (like Celestia or Ethereum post-Dencun) handle verification for you. Your security depends on the infrastructure behind the scenes-not your ability to check data yourself.

Why do some developers say data availability is too complex?

Implementing data availability sampling requires understanding erasure coding, Merkle trees, and probabilistic verification. Ethereum Foundation estimates 80-120 hours of study to get it right. Mistakes can create vulnerabilities. That’s why many projects rely on battle-tested layers like Celestia instead of building their own.

Does GDPR conflict with blockchain data availability?

Yes. GDPR gives users the right to delete personal data. But blockchain is immutable-once data is on-chain, it can’t be erased. This creates legal tension. Solutions are emerging, like storing only hashes on-chain and keeping raw data off-chain, but it’s still an unresolved challenge.

What’s the difference between Bitcoin and Ethereum on data availability?

Bitcoin stores all data on-chain and requires full nodes to verify everything. It’s secure but slow (7 TPS). Ethereum, especially after rollups and Dencun, is shifting toward modular design. Most data is now handled off-chain by rollups, with Ethereum acting as a secure data availability layer. This allows much higher throughput (up to 4,000 TPS) while maintaining security.

15 Responses

Data availability is the unsung hero of blockchain security. Most people think it's about speed or gas fees, but no-it's about whether your transaction actually exists. If the data isn't out there, you're trusting strangers with your coins. That's not decentralization, that's just a fancy word for gambling.

And yeah, Celestia? Game-changer. It's not trying to be Ethereum-it's just doing one thing, and doing it right. No smart contracts, no execution layer. Just pure, verifiable data. That's the future.

Stop treating blockchains like monolithic apps. Modular is the only way forward. Ethereum's Dencun upgrade is the first real step toward that. The cost drop on data posting? That's not a tweak-it's a revolution.

Oh wow, another blog post pretending data availability is new. It’s been a thing since 2018, genius. And yes, ‘erasure coding’ sounds fancy, but it’s just math with extra steps. You’re telling me we need a whole new layer just because people can’t download 500GB? Maybe stop pretending everyone’s a node operator.

Also, GDPR? Yeah, good luck deleting your ‘immutable’ transaction history when the EU comes knocking. Blockchain devs are either delusional or lying. Pick one.

So let me get this straight-we’re building a system where data is supposed to be public, but we’re relying on random sampling to trust it? That’s not security, that’s statistical wishful thinking.

And Celestia? Please. It’s just another centralized consortium in disguise. Who’s running the sampling nodes? Who audits them? You think the ‘honest majority’ won’t get bribed? Give me a break.

This isn’t innovation. It’s a distraction from the fact that blockchain was never meant to scale. We’re just gluing duct tape onto a sinking ship and calling it ‘modular architecture.’

Bro, you wrote a 2000-word essay on why your crypto portfolio might not be as safe as you think. Meanwhile, I’m over here watching my 10k ETH get frontrun by a bot that cost $20 to deploy.

Stop pretending data availability is the problem. The problem is that 99% of users don’t care. They just want to swap tokens and meme. The rest of us are just arguing over how many angels can dance on a blockchain’s head.

Also, ‘proto-danksharding’? Who named this? A Discord mod on acid?

I love how everyone’s treating data availability like it’s some new discovery. It’s just the same old decentralization problem dressed up in fancy math.

But honestly? I’m glad someone’s finally talking about it. Most people think ‘blockchain’ = ‘secure’ and move on. The fact that we’re even having this conversation means we’re getting smarter.

Also, I’m low-key excited for Celestia. It feels like the internet’s first real infrastructure layer that’s actually useful. Not just another token.

Real talk: I don’t run a node. I don’t even know what erasure coding is. But I use DeFi apps every day. If my funds are safe because someone else is sampling data for me? Cool. I’ll take it.

Stop making this so complicated. The average user doesn’t need to understand the math. They just need to know their money won’t vanish because some miner hid a block.

So yes-better DA layers = better for everyone. Even me.

Blockchains are not for everyone. Stop pretending they are. If you can’t handle the data, don’t run a node. Use a wallet that does it for you. Simple.

The real issue? People think crypto is banking. It’s not. It’s tech. And tech evolves. Dencun is the upgrade we needed. Stop complaining. Adapt.

Also Celestia is fire. End of story.

Hey everyone, just wanted to say-this thread is exactly why I love crypto communities. Even when we disagree, we’re talking about real problems.

For those worried about complexity: you don’t have to build it. Use Celestia. Use EigenDA. Let the experts handle the heavy lifting.

And to the skeptics: yes, it’s imperfect. But so was the early web. We didn’t give up then. Don’t give up now.

Keep learning. Keep asking. Keep pushing for transparency. That’s the spirit.

So here’s the thing-data availability isn’t just about security. It’s about freedom. If you can’t verify your own transactions, you’re not owning your assets. You’re renting them from someone who controls the data.

That’s the opposite of what crypto promised.

And yeah, Ethereum’s blob system? It’s not perfect, but it’s the first real attempt to make this scalable without centralizing. I’m not saying it’ll work. But at least they’re trying.

Also, I’ve been running a full node since 2021. It’s a pain. But I’d rather be paranoid than clueless.

It is worth noting that the concept of verifiable data availability transcends technological implementation. It is a philosophical commitment to transparency in systems designed to eliminate trust.

When data is withheld, even temporarily, the foundational axiom of blockchain-immutability through public verification-is compromised. This is not merely a technical challenge; it is an existential one.

Therefore, the adoption of dedicated data availability layers should not be viewed as an optimization, but as a moral imperative.

One cannot claim to uphold decentralization while relying on probabilistic trust models without acknowledging the inherent risk.

Let us not confuse convenience with integrity.

I just want to know if my money is safe. Do I need to read all this? Can someone just tell me yes or no?

Wait, so if I’m using a rollup, and the data availability layer goes down, does that mean my transaction is stuck? Or just unverifiable? What’s the actual impact?

I get that it’s a security thing, but how does it affect me as a user in real time? Like, if I send ETH, will it just disappear? Or sit there forever?

Imagine this: you’re at a concert. The band plays, but the sound engineer hides the audio feed. Everyone’s clapping, but you have no idea if they’re even playing the right song.

That’s data availability.

And now imagine the band says ‘trust us, we’re pros.’

Bro. We’re in 2024. We don’t trust people. We trust math.

So fix the math. Or get out of the way.

Every time I see someone talk about ‘modular blockchains,’ I feel like I’m watching a philosopher try to explain why the moon is made of cheese using calculus.

We’re not solving a problem. We’re building a cathedral to our own ego.

What if the real answer is simpler? What if we just… stopped pretending blockchain can do everything?

Maybe the future isn’t more layers.

Maybe it’s less.

You all sound like you’re trying to justify why your crypto portfolio hasn’t crashed yet.

Here’s the truth: nobody cares about data availability until their funds are frozen.

And by then? It’s too late.

So yeah, celebrate Celestia. Celebrate Dencun. Celebrate your ‘secure’ rollups.

But don’t pretend you’re not just gambling with math you don’t understand.

And when it blows up? Don’t come crying to me.

I told you so.