When Bitcoin drops 70% in six months and your portfolio feels like it’s evaporating, the instinct to panic-sell is strong. But selling at the bottom isn’t survival-it’s surrender. The real game in a crypto bear market isn’t trying to time the bottom. It’s keeping enough of your money intact so you can still play when the tide turns. That’s capital preservation. And it’s not about being scared. It’s about being smart.

Why Bear Markets Are Different Now

Crypto bear markets used to last over a year-sometimes two. The 2018-2019 drop took 371 days and wiped out 84% of Bitcoin’s value. The 2022-2023 bear market? It lasted 298 days. Shorter. Sharper. More brutal in some ways because more people were involved. Institutions, ETFs, retail investors all jumped in during the bull run. Now, when prices fall, they all move at once. That means bigger swings, faster.What’s changed? Regulation. In 2022, the SEC filed 67 enforcement actions against crypto firms in just one quarter. That’s more than the entire 2018 bear market. Stablecoins got crushed when TerraUSD collapsed. Exchanges froze withdrawals. People lost faith. But it also forced the market to grow up. Now, you can’t just throw money at any coin and hope for the best. You need a plan.

Stablecoins: Your Financial Anchor

If you’re holding Bitcoin and Ethereum and prices are crashing, you’re riding a rollercoaster blindfolded. Stablecoins like USDC and USDT are the seatbelt. They’re digital dollars-pegged 1:1 to the U.S. dollar. During the 2022 bear market, portfolios with 30-40% in stablecoins kept 98.7% of their nominal value. That’s not growth. That’s protection.But not all stablecoins are equal. USDC, issued by Circle, stayed within 0.15% of its peg during the worst of the crash. USDT? It dipped as far as 1.8% below $1 during the UST collapse. Why? Reserve transparency. USDC’s reserves are audited monthly. USDT’s aren’t. If you’re going to use stablecoins to preserve capital, use ones with clear, public audits.

And here’s the bonus: you don’t have to just hold them. Platforms like Yield.app let you stake USDC and earn 4.2% to 8.5% annually. That’s better than most savings accounts. But be careful. The Anchor Protocol collapse in 2022 wiped out 68% of users’ funds because it was built on unstable algorithms. Only use stablecoin yield platforms with proven security audits. Messari found that audited DeFi protocols had 83.7% fewer exploits.

Dollar-Cost Averaging: The Quiet Winner

You don’t need to predict the bottom. No one can. But you can show up every week and buy a little more. That’s dollar-cost averaging (DCA). In the 2018-2019 bear market, weekly DCA into Bitcoin cut the average purchase price by 37.6% compared to buying all at once. In 2022, user ‘BearMarketSurvivor’ on Coinrule’s forum bought $50 of Bitcoin every week for nine months. By March 2023, their average entry price was 39.7% lower than the December 2023 peak.Why does this work? Because markets don’t fall in straight lines. They zigzag. Every dip becomes a discount. Every rally becomes a chance to reset. DCA removes emotion. You’re not chasing. You’re not fearing. You’re just buying.

Set it and forget it. Pick your asset-Bitcoin is the most common, used in 68.3% of successful DCA strategies. Decide how much: 5-15% of your total crypto allocation per purchase. Pick a frequency: weekly is best (used by 57.2% of successful users). Do it on Binance, Coinbase, or Kraken. It takes 15 minutes to set up. Then you walk away.

Stop-Loss Orders: Useful, But Dangerous

Stop-losses sound like a safety net. Sell if it drops 10%. Simple. But in crypto, they often become traps.During the May 2021 crash, Bitcoin dropped 30% in 24 hours. A 10% stop-loss saved 18.7% more capital than holding through it. Great. But in the 2022 bear market, where prices slid slowly over months, stop-losses triggered 63.4% of the time prematurely. You’d sell at $28,000, only to see Bitcoin bounce back to $35,000 a week later. You miss the recovery. You get shaken out.

Experts like Dr. Carol Alexander say the sweet spot isn’t 10%. It’s 12.7%. That’s based on Bitcoin’s volatility patterns from 2017 to 2022. But even then, market noise can trigger false signals. During the January 2024 Bitcoin ETF approval hype, BTC swung 22% in one day. Stop-losses triggered for thousands of traders who weren’t ready for the volatility.

Use limit stop-losses, not market ones. Limit orders give you control over the price you sell at. Market orders sell at whatever the price is-often way lower during panic. KuCoin data shows limit stop-losses reduce slippage by 63.8%.

And consider trailing stops. A 5% trailing stop moves with the price. If Bitcoin rises to $45,000, your stop moves up to $42,750. If it drops back, you lock in gains. That’s what one Reddit user did in 2022. They ended up with a 12.3% net gain in fiat terms-because they didn’t sell low.

Diversification: Not All Crypto Is Equal

Holding only Bitcoin might feel safe. But in a bear market, even Bitcoin can drop 70%. Diversification isn’t about chasing the next moonshot. It’s about balance.A portfolio with 60% Bitcoin, 20% Ethereum, 10% DeFi tokens, and 10% stablecoins saw 28.4% less volatility than a pure Bitcoin portfolio in 2022. Why? Ethereum and DeFi didn’t fall as hard as smaller altcoins. And the stablecoins held the line.

But here’s the catch: pure Bitcoin portfolios recovered faster. In 2023, Bitcoin gained 158.2% during the bull run. Diversified portfolios only gained 123.4%. So if you’re preserving capital, you’re not just protecting. You’re positioning. You want to survive the fall and still have room to climb.

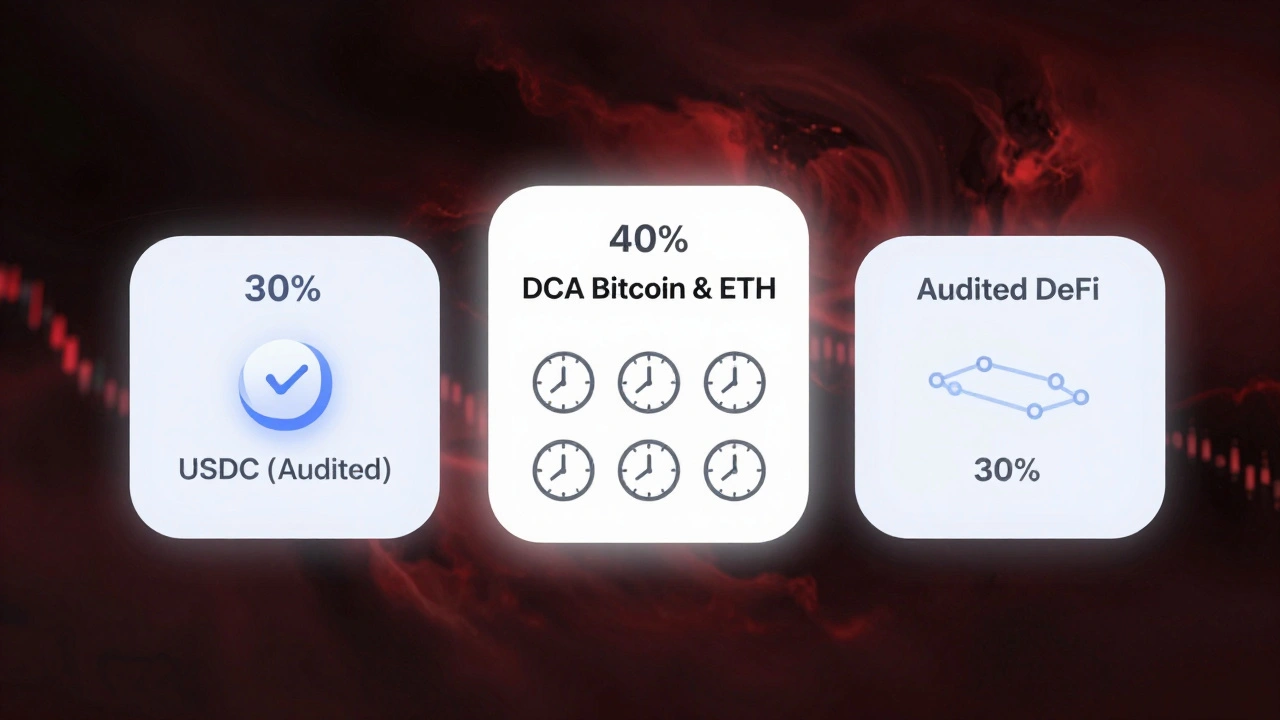

Michael van de Poppe’s strategy is simple: 30% stablecoins, 40% DCA into Bitcoin and Ethereum, 30% into high-quality DeFi protocols with audits. That’s the sweet spot. You’re not betting on everything. You’re betting on the strongest, with a safety net.

The Psychology of Holding On

The hardest part of capital preservation isn’t the math. It’s the mental toll. Watching your portfolio shrink day after day. Seeing friends post about their new buys while you’re stuck in stablecoins. The FOMO is real.But the most successful investors didn’t watch charts. They automated. They set up DCA. They locked away their stablecoins. They stopped checking. One Reddit user said: “The psychological benefit of not having to watch charts daily was as valuable as the financial outcome.”

That’s the hidden win. You sleep better. You make fewer emotional decisions. You stay in the game.

What to Avoid

Don’t chase yield on unaudited protocols. Anchor Protocol’s collapse wiped out thousands. Don’t use market stop-losses. Don’t try to time the bottom. Don’t sell everything because “this time is different.”And don’t ignore the big picture. The market is changing. Spot Bitcoin ETFs launched in January 2024. That’s bringing in institutional money. Standard Chartered predicts future bear markets will see smaller drawdowns-maybe 65-70% instead of 84%. Why? More stable players. More regulation. More tools.

BlackRock’s BUIDL fund, launched in March 2024, lets you invest in tokenized U.S. Treasuries through stablecoins. That’s a bridge between traditional finance and crypto. It’s not speculative. It’s stable. And it’s growing.

Final Strategy: The 3-Part Plan

Here’s what works right now:- 30% in stablecoins - USDC preferred. Keep them in a non-custodial wallet or a reputable platform with audits.

- 40% in systematic DCA - Buy Bitcoin and Ethereum every week. No exceptions. Use 5-15% of your crypto allocation per purchase.

- 30% in high-quality DeFi or yield - Only protocols with third-party audits. Avoid anything that promises 20% APY. If it sounds too good, it’s a trap.

Set it up. Let it run. Don’t touch it unless you’re adding more capital. When the next bull market starts, you’ll be ready-not scrambling.

What Comes Next

The tools are getting smarter. AI-powered stop-losses like 3Commas’ Smart Stop-Loss adjust dynamically based on volatility, cutting false triggers by 47%. On-chain metrics like NUPL (Net Unrealized Profit/Loss) help time DCA better. And with MiCA regulations coming in June 2024, European stablecoins will need 120% reserves. That means safer, more trustworthy options.Capital preservation isn’t about winning the bear market. It’s about being the last one standing when the sun rises again.

What’s the best way to preserve capital in a crypto bear market?

The most effective approach combines 30% in stablecoins like USDC for safety, 40% in systematic dollar-cost averaging into Bitcoin and Ethereum, and 30% in audited DeFi protocols that offer yield. This balances protection, growth potential, and income without taking excessive risk.

Should I use stop-loss orders in a crypto bear market?

Stop-losses can help during sharp crashes but often trigger prematurely in slow, grinding bear markets. If you use them, set them at 12.7% below your entry price (not 10%) and always use limit orders, not market orders. Trailing stops are safer than fixed ones. Many traders get shaken out by volatility spikes, so use them cautiously.

Are stablecoins safe during a crypto crash?

Yes, if you choose the right ones. USDC, backed by Circle and audited monthly, maintained its $1 peg within 0.15% during the 2022 crash. USDT briefly dropped to $0.982 during the Terra collapse due to unclear reserves. Always prefer stablecoins with transparent, regular audits. Avoid algorithmic stablecoins like the now-dead UST.

Can I earn interest on stablecoins during a bear market?

Yes, and you should. Platforms like Yield.app let you stake USDC and earn 4.2% to 8.5% annually. But only use platforms backed by audited protocols. The Anchor Protocol collapse in 2022 wiped out 89% of users’ funds because it was built on an unstable model. Always check for third-party security audits before staking.

Is dollar-cost averaging really better than buying the dip?

Yes, statistically. Since 2017, DCA outperformed lump-sum buying in 78.3% of bear market scenarios. It removes emotion and takes advantage of volatility. In 2019, DCA reduced Bitcoin’s average entry price by 42.1% compared to buying at the peak. Trying to time the dip often leads to waiting too long-or buying too early.

What should I do if I already lost 50% of my portfolio?

Don’t panic. Sell nothing. Shift your focus to preservation. Move 30% of what’s left into stablecoins. Start a weekly DCA plan into Bitcoin and Ethereum with the rest. You’re not trying to recover your losses-you’re trying to rebuild. The market has recovered from worse. Your job now is to stay in the game.

8 Responses

Stablecoins are the unsung heroes of bear markets 🛡️💸. I held 40% USDC during the 2022 crash and slept like a baby while everyone else was crying over their ETH charts. No drama, just steady. And yeah, Yield.app’s 7.8% APY? That’s free money you’re leaving on the table.

I’ve been doing DCA since 2020 and I can’t stress this enough-it’s not sexy, but it’s the only strategy that doesn’t make you want to quit crypto entirely. I started with $25 a week, now I’m at $150. The key isn’t how much you buy, it’s that you never stop. Even when Bitcoin’s at $28K and your portfolio’s down 60%, you keep going. That’s the discipline that separates the survivors from the exiters. And honestly? The psychological relief of not watching the ticker every 10 minutes is worth more than any 10x altcoin.

LOL. ‘Capital preservation’? Sounds like a Wall Street bro who’s scared of losing his crypto allowance. You’re not investing, you’re just hiding in USDC like it’s a safety blanket. Meanwhile, real investors are buying the dip, not babysitting dollar pegs. Also, ‘audited protocols’? Circle and Tether are both controlled by billionaires with zero accountability. This whole post is just fear-mongering dressed up as finance.

I really appreciated how you framed this not as a trading guide, but as a mental framework. The part about not checking charts daily hit me hard-I used to refresh my portfolio every hour, and it was making me anxious, not informed. After I started DCA and moved 30% to USDC, I didn’t look at my wallet for three months. When I finally did, I was down 20% instead of 70%. It wasn’t about the numbers. It was about reclaiming my peace. That’s the real win. Also, thank you for mentioning MiCA. I think regulation, even if it feels frustrating now, is the only thing that’ll make crypto sustainable long-term.

As someone from South Africa, where inflation has eaten 40% of my savings over the past five years, I find this strategy profoundly practical. Stablecoins are not just a hedge against crypto volatility-they are a hedge against systemic economic fragility. I use USDC to preserve value and DCA into Bitcoin as my long-term store of wealth. The discipline required is not easy, but it is the most rational path forward in an uncertain world. Thank you for this clear, structured approach.

Yield.app? Bro, that’s just DeFi with a pretty UI. You think Circle’s audits mean anything? They’re a private company with no real oversight. And DCA? Please. You’re just delaying the inevitable loss. If you really believed in crypto, you’d go all in on Solana or Arbitrum when it’s down 80%. Not hide in USDC like a grandma with her savings in CDs.

stop loss bad dca good stablecoins good dont touch it

you said it best. just keep buying. dont panic. the market always comes back.