Altcoin season isn’t just a buzzword-it’s a measurable market shift that has turned small portfolios into life-changing gains and wiped out others in weeks. If you’ve ever watched Bitcoin climb while your favorite altcoin sat still, you’ve felt the frustration. But here’s the truth: altcoin season doesn’t happen randomly. It follows patterns, triggers, and indicators that smart traders watch closely. And as of December 2024, we’re already in it.

What Exactly Is Altcoin Season?

Altcoin season, or "altseason," happens when at least 75% of the top 50 altcoins outperform Bitcoin over a 90-day window. This isn’t speculation-it’s a metric created by Blockchain Center in 2018 and now tracked daily. The Altseason Index hit 78 in December 2024, meaning the market is officially in altseason territory. That number doesn’t lie.

Think of it like a shift in investor attention. When Bitcoin starts moving up hard-say, after a halving event-people begin to ask: "What else can I buy?" That’s when money flows out of Bitcoin and into altcoins. The result? While Bitcoin might go up 150%, altcoins like Solana or Ethereum can surge 400%, 600%, even 1,000%.

It’s not about luck. It’s about timing. And timing comes from watching the right signals.

How to Spot Altcoin Season Before It Starts

You don’t need a crystal ball. You need five clear indicators.

- Bitcoin Dominance (BTC.D) drops below 50%-This is the most reliable sign. When Bitcoin controls less than half of the total crypto market cap, money is flowing into alts. In late 2021, BTC.D fell to 40%. In December 2024, it was at 42%.

- Altseason Index above 75-If this number is rising and stays above 75 for more than 30 days, you’re in the middle of the move.

- Stablecoin supply spikes-When USDT and USDC balances on exchanges jump suddenly, it means people are moving cash into crypto to buy alts. In October 2024, stablecoin supply on Binance and Coinbase rose 22% in three weeks.

- Futures funding rates turn positive-If traders are paying premiums to hold long positions on altcoins, it means they’re betting big. This happened with SOL and AVAX in November 2024.

- Altcoin trading volume hits 1:1 ratio with Bitcoin-Normally, Bitcoin trades 3x more than all alts combined. During altseason, that ratio flips. In December 2024, altcoin volume matched Bitcoin’s for the first time since 2021.

Most retail traders wait for the price to explode before jumping in. That’s when they lose money. The winners are the ones who see these signs early and start positioning before the hype hits Twitter.

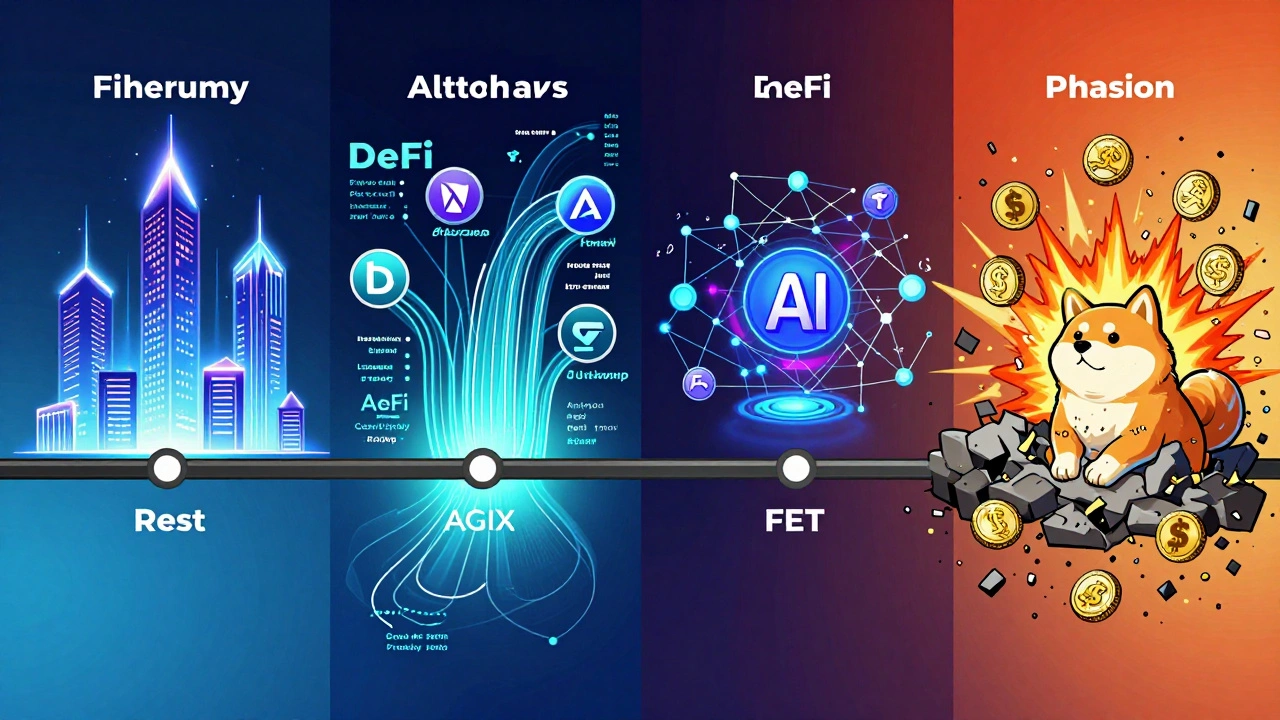

The Altcoin Season Cycle: What Happens When It Starts

Altcoin season doesn’t just jump from zero to 1,000%. It unfolds in phases.

Phase 1: Infrastructure & Layer-1 Tokens (Weeks 1-6)

This is where the smart money goes first. Ethereum, Solana, Cardano, and Avalanche lead the charge. Why? Because they’re the foundation. If you’re building on top of them, you need them to work. In 2021, Solana gained 421% in this phase. In 2024, Ethereum rose 189% as staking yields and DeFi usage surged.

Phase 2: DeFi and Layer-2 Tokens (Weeks 7-14)

Once the base is set, money flows into protocols that use those chains. Uniswap, Aave, and Curve see massive volume spikes. Layer-2s like Polygon and Arbitrum follow because they solve Ethereum’s high fees. During the 2021 cycle, Arbitrum’s token jumped 380% in six weeks after its mainnet launch.

Phase 3: AI, Gaming, and Metaverse Tokens (Weeks 15-20)

This is where speculative energy picks up. Tokens like Fetch.ai, SingularityNET, The Sandbox, and Decentraland start moving. These projects often have real use cases-but in this phase, hype drives prices. In late 2024, AI tokens like AGIX and FET gained 400-600% as institutional interest in AI + crypto grew.

Phase 4: Meme Coins and Low-Cap Gems (Weeks 21-26)

This is the danger zone. Dogecoin, Shiba Inu, and obscure tokens with no fundamentals explode. Why? Because retail traders, scared of missing out, chase anything with a 10x chart. In November 2024, one meme coin rose 8,000% in 12 days-then crashed 92% in a week. This is where most people lose everything.

Know the phase you’re in. Don’t chase memes in Phase 1. Don’t ignore infrastructure in Phase 4.

Why Altcoin Season Is Different in 2025

Altseasons in 2017 and 2021 were wild, but they were mostly retail-driven. Today? Institutions are in the game.

Grayscale’s December 2024 report showed institutional altcoin holdings jumped from 8% to 22% of their total crypto portfolios. That’s not small. It means big money is now betting on altcoins-not just Bitcoin. This changes the game.

Why? Because institutions don’t chase memes. They look for liquidity, regulation, and use cases. That means the next altseason will be less about wild pumps and more about structured rotations. AI tokens, enterprise blockchain projects, and regulated DeFi platforms will lead. Meme coins? They’ll still pop-but they won’t drive the whole market anymore.

Also, the timing is shifting. Historically, altseason started 18 months after a Bitcoin halving. The April 2024 halving suggested a late 2025 start. But in December 2024, the Altseason Index was already at 78. That means the cycle is accelerating. Liquidity from stablecoins, ETF inflows, and global macro shifts are compressing the timeline.

Real Stories: Winners and Losers

One Reddit user, u/AltcoinGuru2023, rotated 20% of their portfolio from Bitcoin into AI tokens in October 2024. By mid-December, they had a 347% return. They took profits before BTC.D hit 42%. They didn’t get greedy.

Another user, u/CrashedMyPortfolio, saw Shiba Inu spike 500% in November 2024 and went all-in. When Bitcoin dropped 15% the next week, Shiba crashed 78%. They lost 68% of their altseason gains. Why? Because they thought "altseason means alts don’t crash." They were wrong.

Altcoins don’t ignore Bitcoin. They just move faster. When Bitcoin falls, alts fall harder. That’s why 85% of retail traders who chased alts in late 2024 lost money-not because the market was fake, but because they didn’t manage risk.

How to Trade Altcoin Season Without Getting Wiped Out

You don’t need to be a genius. You just need rules.

- Never go all-in. Allocate no more than 10% of your portfolio to any single altcoin.

- Take profits early. When an altcoin hits 2x, sell half. When it hits 3x, sell another 25%. Let the rest ride with a trailing stop.

- Only trade high-volume alts. Avoid coins with daily volume under $50 million. Low volume = easy manipulation.

- Watch BTC.D daily. If it starts rising back above 45%, altseason is ending. Exit your positions before the crash.

- Use limit orders. Market orders during volatility can get you filled at terrible prices. Always use limit orders.

One trader in Adelaide told me: "I don’t try to catch the top. I just catch the rise. I let the market tell me when to leave. That’s how I made 5x last year without ever losing my principal."

What Comes After Altcoin Season?

When BTC.D climbs back above 55%, altseason is over. That’s when Bitcoin starts dominating again. This usually happens after a sharp correction-often 20-40% across the altcoin market.

Don’t panic. This isn’t the end. It’s a reset. The best time to buy Bitcoin again is after altseason collapses. That’s when it becomes cheap again.

And here’s the long-term view: altseason isn’t going away. But it’s changing. It’s becoming more predictable, more institutional, and less chaotic. The next cycle might not have 10,000% meme pumps-but it could deliver steady 300-500% gains in solid projects. That’s actually better for long-term wealth.

Final Thought: Altcoin Season Is a Tool, Not a Miracle

Altcoin season isn’t magic. It’s a market behavior pattern, like seasonal sales or holiday shopping spikes. It happens because people act the same way under similar conditions.

If you wait for someone to tell you "it’s time," you’re already late. If you study the indicators, track the phases, and stick to your rules-you don’t need to predict the future. You just need to react to what’s already happening.

The next altseason could be bigger. Or shorter. Or more volatile. But one thing’s certain: it’s coming. And if you know how to read the signs, you won’t just survive it-you’ll profit from it.

How do I know if altcoin season has started?

Altcoin season starts when the Altseason Index hits 75 or higher, Bitcoin dominance drops below 50%, and at least 75% of the top 50 altcoins outperform Bitcoin over 90 days. You’ll also see stablecoin supply rise, altcoin trading volume match Bitcoin’s, and funding rates turn positive. These signals together confirm the shift.

Is altcoin season guaranteed after every Bitcoin halving?

Historically, altseason has followed Bitcoin halvings by about 18 months. But in 2024, it started earlier-just 8 months after the April 2024 halving. This suggests market dynamics are changing. Institutional capital, stablecoin liquidity, and global macro conditions now influence timing more than just halving cycles alone.

Should I sell my Bitcoin to buy altcoins?

Don’t sell all your Bitcoin. Instead, rotate a portion-10% to 20%-into high-liquidity altcoins during early altseason. Keep the rest in Bitcoin as your anchor. This way, you benefit from altcoin growth without losing your core position if the market turns.

Are meme coins a good investment during altseason?

Meme coins can deliver massive returns-but they’re extremely risky. They often peak in the final weeks of altseason and crash hard. Only allocate 1-5% of your portfolio to them, and never hold them long-term. Treat them like lottery tickets, not investments.

How long does altcoin season usually last?

Most altseasons last 2 to 6 months, with 3 months being the average. The 2021 cycle lasted 4 months. The 2024-2025 cycle is showing signs of lasting longer-possibly 5 to 7 months-due to higher institutional participation and sustained liquidity. Watch Bitcoin dominance: if it stays below 45% for over 120 days, the trend is still strong.

What altcoins should I watch in 2025?

Focus on Layer-1s like Ethereum and Solana, DeFi protocols like Uniswap and Aave, and Layer-2s like Polygon and Arbitrum. AI tokens like Fetch.ai and SingularityNET are gaining traction. Avoid low-volume coins under $50 million daily trade volume. Stick to projects with real usage, not just hype.

Can altcoin season happen without Bitcoin rising?

No. Altcoin season always follows a strong Bitcoin rally. Bitcoin needs to establish upward momentum first-usually a 50%+ gain over 3-6 months-to trigger capital rotation. Without that base, altcoins lack the liquidity and confidence to surge. Don’t chase alts if Bitcoin is flat or falling.

8 Responses

so like… altseason is just bitcoin’s hype train letting people hop on with their dogecoin tickets?? 🤔 i mean, sure, i bought some SOL last october and now my coffee budget is legit… but also, why does everyone act like this isn’t just casino math with extra steps??

NO. NO. NO. You can’t just say ‘altseason started in December 2024’ and expect people to believe you. The Altseason Index is NOT an official metric-it’s a made-up indicator by some random blog. BTC.D at 42%? That’s nothing. In 2021 it hit 38%. You’re cherry-picking data to sell a narrative. And don’t even get me started on ‘AI tokens’-Fetch.ai? That’s a ghost project with 3 devs and a Discord server. This is financial misinformation wrapped in bullet points.

been watching btc.d for months. it’s been below 45% since november. stablecoins spiked. volume parity happened. i didn’t need a 2000-word essay to see it. i just moved 15% out of btc into eth and arb. no big deal.

It is, indeed, a fascinating socio-economic phenomenon, albeit one that is predicated upon a speculative asset class with no intrinsic value, and yet, paradoxically, it continues to attract capital from individuals who, despite the absence of regulatory oversight, believe that algorithmic indicators can predict human behavior with any degree of reliability. The notion that ‘timing’ can be quantified through a composite index-however meticulously constructed-is, in my view, a dangerous illusion, one that conflates correlation with causation, and ultimately, leads to ruinous outcomes for those who mistake pattern recognition for predictive power.

lol i read all that. honestly? just buy btc and chill. alts are just noise. if you’re not rich yet, you’re doing it wrong. also, why are there so many words? i’m tired.

Let me be perfectly clear: you are all missing the forest for the trees. The entire premise of altseason is built upon a foundation of centralized exchanges, fiat on-ramps, and institutional manipulation-none of which have anything to do with decentralization. You speak of ‘phases’ as if they were divine stages in a cosmic ritual, yet you ignore the fact that every single ‘winning’ altcoin in your list is listed on Binance, Coinbase, and Kraken. You are not participating in a revolution-you are participating in a casino where the house prints the chips, sets the odds, and changes the rules every time you blink. The real altseason? When you stop trusting charts and start trusting code. Until then, you are just feeding the machine.

thank you for writing this it’s so helpful i’ve been scared to get into alts but now i feel like i get it. i’m going to start small like you said with 10% and watch btc.d every day. you’re right about taking profits early too i always hold too long and then cry when it drops 😅

Actually, your definition of altseason is inaccurate. The original metric from Blockchain Center uses a 90-day rolling window of outperformance, not a static snapshot. Your claim that the index 'hit 78 in December 2024' is misleading without context-was it sustained? Was it above 75 for 30+ days? You also cite volume parity, but you don’t specify whether you’re measuring spot volume, futures, or cross-exchange liquidity. These distinctions matter. Your article is well-intentioned, but lacks rigor. Please revise.